Record Retention Guide

How Long Should You Keep Tax & Financial Records?

Not sure how long to hang on to tax and financial documents? You’re not alone. Keeping records for the right amount of time helps protect you in the event of audits, disputes, or questions — without drowning in paper.

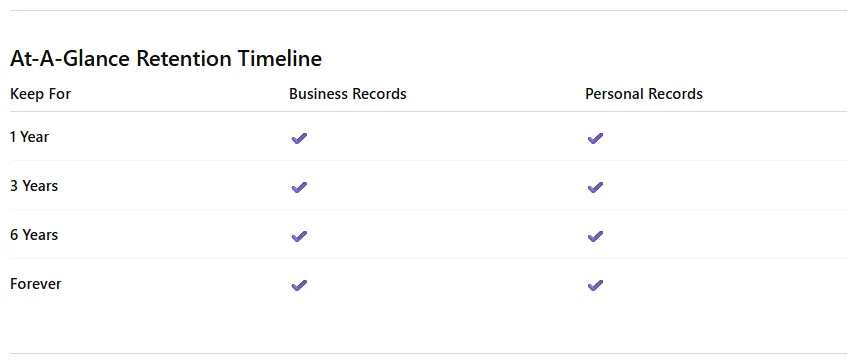

Below is a general guideline for business and personal records, plus best practices for storing and safely disposing of documents.

Quick note: These are general recommendations. Certain situations may require longer retention.

At-A-Glance Retention Timeline

Best Practice: Create a Digital Backup

Keeping a backup set of records is easier than ever — and highly recommended.

Many banks, payroll providers, and insurers already provide electronic statements

Paper documents can be scanned and saved digitally

Store backups on:

External hard drives

Encrypted cloud storage

Secure online backup services

Online backup is often the safest option since files are stored off-site. If a fire, flood, or natural disaster occurs, your records remain protected.

⚠️ Important: Protect Yourself From Identity Theft

Once documents are no longer needed, do not throw them in the trash.

Shred paper documents containing personal or financial information

Securely delete digital files

Avoid recycling unshredded records

Identity theft is real, common, and expensive. Proper disposal matters.

Business Record Retention

Business Documents to Keep for 1 Year

Correspondence with customers and vendors

Duplicate deposit slips

Purchase orders (non-primary copies)

Receiving sheets and requisitions

Stockroom withdrawal forms

Stenographer or internal notebooks

Business Documents to Keep for 3 Years

Employee personnel records (after termination)

Employment applications

Expired insurance policies

General correspondence

Internal audit reports and internal reports

Petty cash vouchers

Physical inventory tags

Employee savings bond registration records

Time cards for hourly employees

Business Documents to Keep for 6 Years*

Accident reports and claims

Accounts payable & receivable ledgers

Bank statements and reconciliations

Cancelled checks

Employment tax records

Expense reports and schedules

Expired contracts and leases

Inventories

Customer invoices

Payroll records and summaries

Sales records

Travel and entertainment records

Vendor and employee payment vouchers

*Records involving bad debt deductions or worthless securities should be kept 7 years.

Business Records to Keep Forever

While not required by law, these documents should be retained indefinitely:

Tax returns and worksheets

CPA audit reports

Corporate formation documents

Financial statements (year-end)

Depreciation schedules

Property deeds and records

Investment confirmations

Legal records and correspondence

Retirement and pension records

Trademarks and patents

IRS audit and revenue agent reports

Personal Record Retention

Personal Documents to Keep for 1 Year

Bank statements

Paycheck stubs (until reconciled with W-2)

Cancelled checks

Monthly retirement or investment statements

Personal Documents to Keep for 3 Years

Credit card statements

Medical bills (for insurance disputes)

Utility records

Expired insurance policies

Personal Documents to Keep for 6 Years*

Supporting tax return documents

Accident reports and claims

Medical bills (if tax-related)

Property improvement receipts

Sales receipts

Wage garnishment records

*Bad debt or worthless security documentation should be kept 7 years.

Personal Records to Keep Forever

Income tax returns and payment records

CPA audit reports

Legal documents

Investment trade confirmations

Retirement and pension records

Important correspondence

Special Circumstances

Some documents should be kept based on life events or agreements:

Car records: Keep until sold

Warranties: Keep for product life

Mortgages / deeds / leases: Keep 6 years beyond payoff or expiration

Property improvement records: Keep until property is sold

Stock & bond records: Keep 6 years after sale

Insurance policies: Keep for policy life

Pay stubs: Keep until W-2 is verified

Not Sure What to Keep?

If you’re unsure whether to keep or discard a document, err on the side of caution — or ask us. We’re happy to help you sort it out.